Mastering Derivatives Seminar

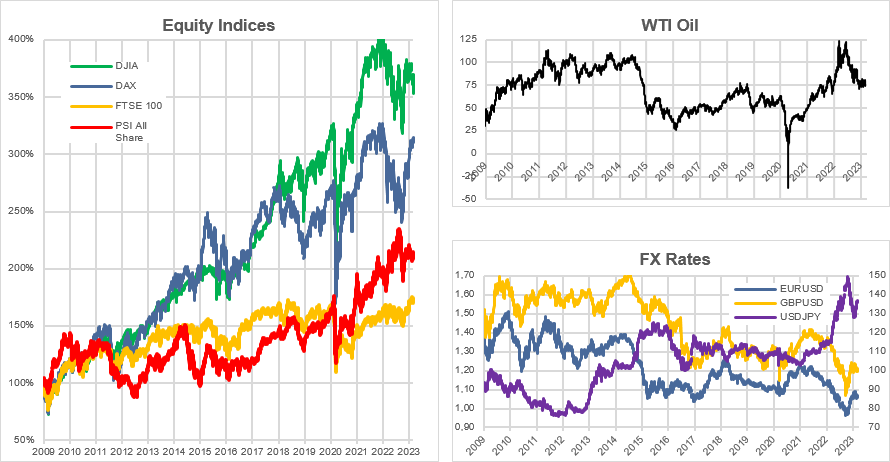

The global financial markets have shown considerable volatility in recent years, especially over the past two years, as a result of the coronavirus pandemic, energy prices, and the geopolitical situation in Eastern Europe.

Derivatives provide flexible tools that allow banks, investors, and corporates to protect against the downside while maintaining exposure to the upside, to enhance price or yield, to make money in a stagnant market, to implement optimal buying or selling strategies over time, and many other possibilities.

WHO SHOULD ATTEND

Anyone working in the financial markets, investment managers, and those working in private wealth management.

PROGRAM OBJECTIVES

The global financial markets have shown considerable volatility in recent years, especially over the past two years, as a result of the coronavirus pandemic, energy prices, and the geopolitical situation in Eastern Europe.

Derivatives provide flexible tools that allow banks, investors, and corporates to protect against the downside while maintaining exposure to the upside, to enhance price or yield, to make money in a stagnant market, to implement optimal buying or selling strategies over time, and many other possibilities.

This seminar explains how derivatives are priced, valued, and used in practical, real-world applications focusing on Europe in general, and Portugal in particular. The principal objectives are to:

- Give participants a clear understanding of the basics and fundamentals of derivative products

- Ensure participants have an intuitive understanding of derivatives pricing

- Demonstrate the practical applications of derivatives and their use by clients

- Consider the needs and perspectives of investors who need performance-driven solutions

- Promote pro-active and innovative strategies using derivative products that add real value

- Consolidate the learning experience by giving participants hands-on experience of derivatives using simulations, practical workshops, and case studies

At a time of considerable uncertainty in the markets, this seminar provides a timely insight into the management and use of derivatives in solving the problems faced by banks, investors, corporates, hedge funds, and other participants in the markets.

Simulation

The seminar features the award-winning Global Trader Cloud simulation which includes powerful analytical tools for structuring hedging solutions, identifying trading strategies, and attributing profit and loss. Using the simulator, participants will gain a deep and practical understanding of how derivatives can be used and a wide range of hedging and trading applications.

Program Structure

The program will be run over three days from 09:00 to 12:30 and 13:30 to 17:30, with each session comprising a number of engaging components, including:

- Interactive discussion and instructor-led presentations, encouraging frequent questions.

- Q&A sessions where the instructor can resolve any aspects causing difficulty in comprehension.

- Instant polls to check on pre-existing knowledge or to gauge the cross-section of views or ideas.

- Workshops, cases, and mini projects for participants to work on in groups.

- Discussions of and presentations by participants of case study solutions.

- Interactive simulations and subsequent debriefing.

- Quick quizzes to check that participants have assimilated and internalized the learning content.

Pre-Course Self-Study

To maximise the benefit of the live sessions, we recommend that participants complete a short series of eLearning courses that introduce futures, options, and swaps. Those already familiar with the basics can test their knowledge by completing the short end-of-course exams. Participants can also try their hand at three short case study exercises.

PRE-COURSE SELF-STUDY

Introduction to Futures

- Definitions and terminology of futures

- Trading features

- How clearing and margin systems work

- Standardization of contracts

- Physical delivery vs. cash settlement

- Advantages and uses for futures

Case Study: Margining

Self-Study – Introduction to Options

- Options definitions and terminology

- Calls and puts; buying and selling

- American vs. European style

- In-, at-, and out-of-the-money

- Intrinsic and time value

- Profit profiles at maturity

Case Study: Using a Call Option

Self-Study – Introduction to Swaps

- Definitions and terminology

- Cash flows and timing

- Quotation conventions

- Interest rate swaps

- Hedging applications

Case Study: Using Interest Rate Swaps to Lower Borrowing Costs

DAY ONE – EQUITY DERIVATIVES

Program Introduction

Stock-Index Futures

- Contract definitions

- Cash-and-carry pricing

- Hedging equities portfolios using futures

- Tactical asset allocation using futures

Tactical asset allocation using PSI20 and Bund futures contracts

Principles of Option Pricing

- An intuitive insight into option pricing

- Put-call parity

- Volatility – historical vs. implied

- Volatility smiles and skews

- Option Greeks

Option pricing workshop

Combining Options

- Designing your own structure – a fluent transition between payoff diagrams and component parts

Challenge – Building a bull spread

Price and Yield Enhancement Strategies

- Price and yield enhancement strategies

- Income generation strategies

Challenge – Building a double-up structure

Break

Option Trading Strategies

- Directional vs. volatility trading

- Near vs. far dates

- Out-of-the-money vs. at-the-money

- Directional views with options

- Trading volatility – straddles and strangles

- Trading the smile – ‘flies’ and risk reversals

Participants will be able to structure and trade a portfolio of options using ACF’s Global Trader simulation, based on their view of forthcoming market prices and implied volatility. At the end of simulation, the instructor will conduct an in-depth debriefing, showing how profits can be attributed between delta and vega exposures.

Querifi knowledge retention quiz

DAY TWO – FX AND INTEREST RATE DERIVATIVES

Review of FX Forwards

- Pricing of outright forwards

- Relation between spot and forward markets

- Impact of interest rates

- Forward discounts and premiums

- Quoting forward rates using swap points

Challenge – Avoiding currency risk on foreign investments

Understanding FX Options

- Calls are Puts!

- FX option trading conventions

- Key dates

- Tokyo vs. New York cuts

- Quoting volatility

- Quoting deltas

- Live options vs. delta exchange

The 25 ⍙ strangle and the 25 ⍙ risk reversal

FX option pricing workshop

Understanding Interest Rate Swaps

- Quotation and trading conventions

- Documentation – ISDA and CSA

- Interest rate swaps – vanilla and non-standard

- Overnight Indexed Swaps (OIS)

- Swap Execution Facilities (SEFs)

- Central Counterparties – SwapClear

- Currency swaps

- Replacing LIBOR – SOFR and other benchmarks

- Asset swaps

Swap Applications

- Fixing financing costs

- Fixing investment returns

- Reducing financing costs

- Increasing investment returns

Case study – Swap applications in funding and investing

Yield Curves, Pricing and Valuing Swaps

- Discount factors and the discount function

- Zero-coupon rates

- Swap and par rates

- Forward rates

- Links between swap, zero & forward rates

- Calculating discount factors

Deriving the discount function from market rates

Pricing and Valuing Swaps

- Swap valuation principles

- Valuing the fixed leg

- Valuing the floating leg

- Valuing a swap

- Pricing a swap

- Cancelling or unwinding a swap

Pricing and valuing standard and non-standard swaps

Trading Ideas using Swaps

- Swap spreads

- Trading the yield curve

- Directional trade example

- Relative value example

Case study – Trading the swaps curve

Querifi knowledge retention quiz

DAY THREE – INTEREST RATE OPTIONS AND CREDIT DERIVATIVES

Interest Rate Options

- Review of terminology

- Interest rate caps

- Constructing and pricing an interest rate cap

- Interest rate floors and collars

- Cap/floor parity

- Swaptions

- Payers / receivers parity

Swaption pricing workshop

Interest Rate Options

- Cancellable and extendible swaps

- Creating a cancellable / extendible swap

Challenge – Creating a cancellable swap

Single-Name CDS

- Introducing credit derivatives

- Terms and definitions

Case study – Using CDS to exploit a view

Single-Name CDS

- Credit events

- Settlement methods

- Auctions

- Determination Committees

- Market and trading conventions

- Standardized premiums and recovery rates

CDS Applications

- Managing credit risk exposure

- Hedging default risk

- Providing market access

- Directional trading

- Exploiting relative value

- Trading the CDS basis

- Curve trades

Using CDS

Index Products

- The CDX and iTraxx indices

- Geographic and sector coverage

- Index series and versions

- Index trading applications

Case study – Trading the CDX

CDS Trading Simulation

Participants will be able to trade a number of single-name CDS with the aim of exploiting their views on evolving credit conditions. At the end of the simulation the instructor will conduct an in-depth briefing analysing participants’ strategies and the resulting risk/return profiles.

Program Close

INSTRUCTOR

Dr Lawrence Galitz is a director and founder of ACF Consultants. Dr Galitz has an international reputation for delivering training seminars for the Global Financial Markets. His book – the Financial Times Handbook of Financial Engineering – when published has become an international standard. He has also contributed to The Handbook of European Fixed Income Securities (2004) edited by Frank Fabozzi.

ABOUT ACF

ACF Consultants provides learning services and supporting technology to the finance sector. Our clients are global investment and commercial banks, financial institutions, and regulators. ACF is innovative, resourceful, and agile, and we aim to provide a personal tailored service to every client.

LOCATION: Lisboa (Location to be confirmed)

DURATION: 3 Days